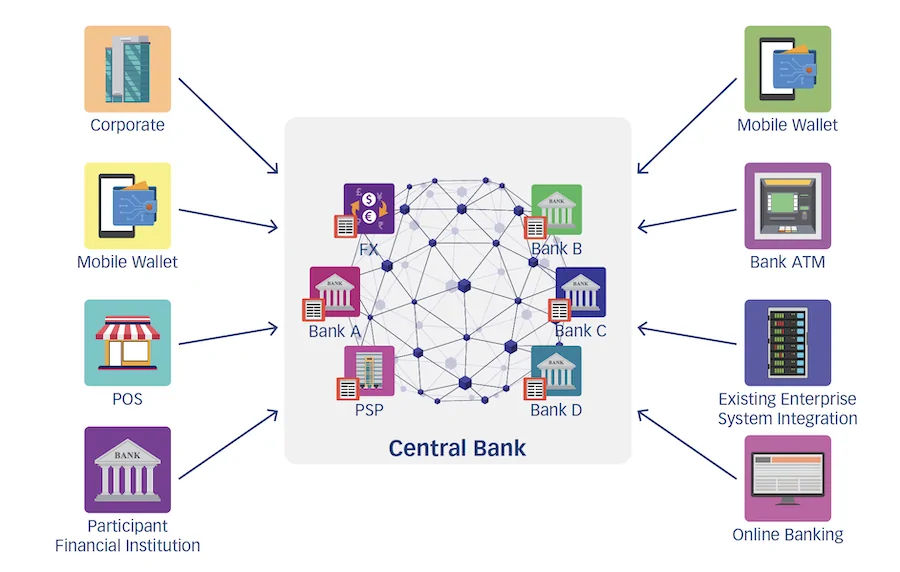

The International Monetary Fund (IMF) is proposing a unified “trust ledger” system called XC to enhance safety, speed, and access in global cross-border payments. This centralized ledger would enable seamless interoperability between CBDCs, national currencies, and legacy financial rails.

According to IMF monetary chief Tobias Adrian, XC offers four key advantages:

- Settlement in central bank reserves for security

- Interoperability with domestic currencies and old systems

- Managing information flows to ease economic friction

- Reliance on transparency and rules of global finance

By streamlining compliance and monitoring, XC aims to ensure payments reliably reach recipients while preventing money laundering, terrorist financing, and other criminal exploits.

XC: Addressing the Shortcomings of Cross-Border Transactions

The IMF is exploring XC as a solution to the lingering inefficiencies in current cross-border payment channels. Existing infrastructure continues to suffer from:

- Slow settlement times

- High costs

- Error rates

- Limited access

These pain points persist due to fragmentation across payment systems globally. Domestic networks remain siloed, using proprietary message standards and settlement rails not interoperable with other countries.

There is also inadequate coordination around compliance, security protocols, and data sharing. This complicates transfers as money moves across multiple intermediaries before reaching its final destination. It also introduces vulnerabilities at hand-off points between systems.

As Adrian noted, perhaps the biggest cross-border payments challenge is establishing trust and transparency between disparate regulatory and technology regimes globally. Hence where the promise of XC lies.

XC: Unlocking the Potential of CBDCs for Cross-Border Flows

XC would not only connect legacy payment systems but also clear the path for central bank digital currencies (CBDCs) to transform cross-border transactions.

CBDCs offer a chance to build modernized payment infrastructure from the ground up. Digital currencies could enable real-time settlement and hyper-efficient compliance via integrated ledgers between central banks.

But the global rollout of dozens of proprietary CBDCs could also further fragment the payments landscape. This underscores the need for unifying platforms like XC that allow CBDCs to seamlessly interoperate domestically and internationally.

The IMF expects that growing adoption of CBDCs will put pressure on existing systems and expose more of their limitations over this decade. Hence why the urgency now to establish interlinking mechanisms like XC.

Ongoing Efforts to Unlock Faster, More Affordable Cross-Border Payments

The IMF’s proposal comes as the Bank for International Settlements (BIS) has launched similar cross-border payment projects. Initiatives like Project Mandala and Project mBridge also introduce centralized systems to smooth transactions between CBDCs and automated compliance processes.

However, Adrian admitted the world still lacks adequate infrastructure for affordable, efficient cross-border payments and messaging. Building out technology like XC across the IMF’s 190 member countries will require substantial coordinated effort.

As CBDCs gain global traction, central banks are racing to modernize complex existing payment channels. Unified trust ledgers could be the key to unlocking faster, more inclusive international transactions. But realizing that vision depends on countries embracing collaborative systems like the IMF’s XC.